Which Account Is Not Classified As A Selling Expense?

They would not generally be removed, especially if any transaction had been posted to the account … A corresponding credit entry is made that will reduce an asset or increase a liability. Jun 13, 2021 · a noninterest expense is an accounting classification for particular costs incurred by financial companies that are not related to the payment of interest. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. Continue to use account 4930 if this type of expense does not need to be tracked separately.

… list of account titles in …

Cash comprises currency, coins, petty cash petty cash petty cash means the small amount that is allocated for the purpose of day to day operations. Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense). A chart of accounts (coa) is a list of financial accounts set up, usually by an accountant, for an organization, and available for use by the bookkeeper for recording transactions in the organization's general ledger.accounts may be added to the chart of accounts as needed; Sep 25, 2020 · bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Expenses often are divided into two broad sub classicifications selling expenses and administrative expenses. They would not generally be removed, especially if any transaction had been posted to the account … The adjusting entry should be made as follows: These represent the resources expended, except for inventory purchases, in generating the revenue for the period. (ias 1.104) the major exclusive of costs of goods sold, are classified as operating expenses. … list of account titles in … The first thing that comes to mind when one thinks about the business transaction in terms of accounting is accounts title. Debit the appropriate expense … You accrue expenses by recording an adjusting entry to the general ledger.

Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense). Jun 13, 2021 · a noninterest expense is an accounting classification for particular costs incurred by financial companies that are not related to the payment of interest. Read more, checking account checking account a checking account is a bank account that allows … You accrue expenses by recording an adjusting entry to the general ledger. The purchase of an asset such as land or equipment is not considered a …

Every time an accountant posts some accounting entry in the system, these account titles are updated to reflect the impact of the transaction.

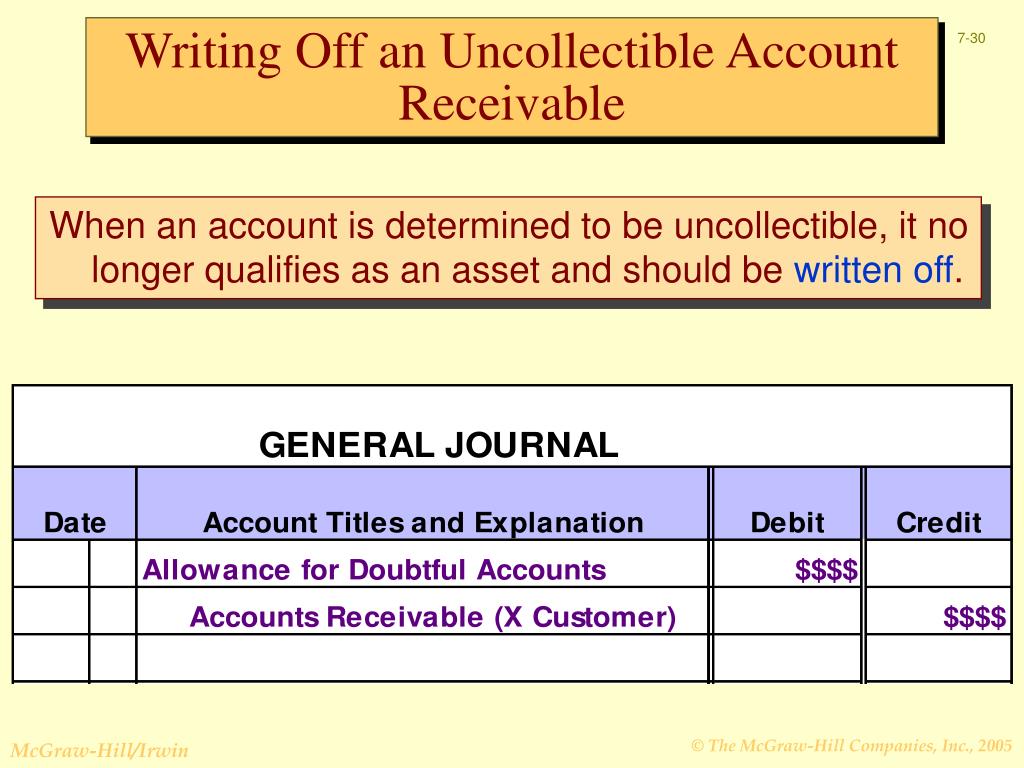

Cogs does not include general selling expenses, such as management salaries and advertising expenses. The purchase of an asset such as land or equipment is not considered a … Read more, checking account checking account a checking account is a bank account that allows … Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense). … list of account titles in … The first thing that comes to mind when one thinks about the business transaction in terms of accounting is accounts title. A chart of accounts (coa) is a list of financial accounts set up, usually by an accountant, for an organization, and available for use by the bookkeeper for recording transactions in the organization's general ledger.accounts may be added to the chart of accounts as needed; Jun 13, 2021 · a noninterest expense is an accounting classification for particular costs incurred by financial companies that are not related to the payment of interest. These represent the resources expended, except for inventory purchases, in generating the revenue for the period. Expenses often are divided into two broad sub classicifications selling expenses and administrative expenses. (ias 1.104) the major exclusive of costs of goods sold, are classified as operating expenses. Sep 25, 2020 · bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. You accrue expenses by recording an adjusting entry to the general ledger.

They would not generally be removed, especially if any transaction had been posted to the account … Continue to use account 4930 if this type of expense does not need to be tracked separately. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. Cash comprises currency, coins, petty cash petty cash petty cash means the small amount that is allocated for the purpose of day to day operations. You accrue expenses by recording an adjusting entry to the general ledger.

The adjusting entry should be made as follows:

May 06, 2021 · make the appropriate adjusting entry. Jun 13, 2021 · a noninterest expense is an accounting classification for particular costs incurred by financial companies that are not related to the payment of interest. Read more, checking account checking account a checking account is a bank account that allows … (ias 1.104) the major exclusive of costs of goods sold, are classified as operating expenses. Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense). The first thing that comes to mind when one thinks about the business transaction in terms of accounting is accounts title. Continue to use account 4930 if this type of expense does not need to be tracked separately. Debit the appropriate expense … Every time an accountant posts some accounting entry in the system, these account titles are updated to reflect the impact of the transaction. Continue to use account 4930 if this type of expense does not need to be tracked separately. The adjusting entry should be made as follows: It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. A corresponding credit entry is made that will reduce an asset or increase a liability.

Which Account Is Not Classified As A Selling Expense?. Cogs does not include general selling expenses, such as management salaries and advertising expenses. A chart of accounts (coa) is a list of financial accounts set up, usually by an accountant, for an organization, and available for use by the bookkeeper for recording transactions in the organization's general ledger.accounts may be added to the chart of accounts as needed; … list of account titles in … Expenses often are divided into two broad sub classicifications selling expenses and administrative expenses. (ias 1.104) the major exclusive of costs of goods sold, are classified as operating expenses.

Post a Comment for "Which Account Is Not Classified As A Selling Expense?"